Employer payroll tax rates

For all quarters the Employer Payroll Tax rate is 00021. Ad Payroll Employment Law for 160 Countries.

Types Of Taxes Anchor Chart Financial Literacy Lessons Teaching Life Skills Life Skills Lessons

Global salary benchmark and benefit data.

. The standard FUTA tax rate is 6 so your max contribution per employee could be 420. Nonprofit and public entity employers who choose another method are known as reimbursable employers. Make Your Payroll Effortless So You Can Save Time Money.

Both employers and employees are responsible for payroll taxes. Employers are solely responsible for paying federal unemployment taxes. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Social Security and Medicare Withholding Rates. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each.

Employer rate of 145 plus 40 of the employee. Make sure you are locally compliant with Papaya Global help. 1 day agoIn most cases the federal payroll tax rate is about 153 with the employee covering 765 and the employer covering 765.

Payroll Seamlessly Integrates With QuickBooks Online. Ad Get Ahead in 2022 With The Right Payroll Service. Sign Up Today And Join The Team.

The tax rate is 6 of the first 7000 of taxable income an employee. File and Pay Employer Payroll Taxes Including 1099. Focus on Your Business.

In total Social Security is 124 and Medicare is 29 but the taxes are split evenly between both. After that your contribution tax rate varies depending in part on how much youve paid in UI benefits. If youre self-employedas a sole proprietor or.

Sign up make payroll a breeze. Ad Fast Easy Accurate Payroll Tax Systems With ADP. However you can also claim a tax credit of up to 54 a max of 378.

For social security taxes. Different rates apply for these taxes. You report and pay Class 1A on these types of payments during the tax year as part of your payroll.

Simply the best payroll software for small business. Over 900000 Businesses Utilize Our Fast Easy Payroll. Below are federal payroll tax rates and benefits contribution limits for 2022.

In 2022 the Social Security tax rate is 62 for employers and employees. Employer rate of 62 plus 40 of the employee rate of 62 for a total rate of 868 of wages. Payroll tax percentage is 153 of an employees gross taxable wages.

Most employers are tax-rated employers and pay UI taxes based on their UI rate. New employers are assigned a 34 percent UI rate for two to three years. Ad 4 out of 5 customers reduce payroll errors after switching to Gusto.

Payroll taxes that both employees and employers pay Both employers and employees pay FICA tax or Social Security and Medicare taxes as a result of the Federal Insurance Contributions. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Sign Up Today And Join The Team.

Learn About Payroll Tax Systems. Put Your Payroll Process on Autopilot. Commuter Transportation Benefit Limits.

Pay FUTA unemployment taxes. The current tax rate for social security is 62 for the employer and 62 for the. The National Insurance class 1A rate for 2022 to 2023 is 1505 Pay.

Employer Requirement to Notify Employees of Earned Income Tax Credit. Learn About Payroll Tax Systems. The Guide to Calculating the Employer Payroll Tax should be used to understand how to calculate the Employer Payroll Tax.

40 Free Payroll Templates Calculators ᐅ Templatelab Payroll Template Payroll Payroll Checks

Pin Page

Types Of Taxes Anchor Chart Financial Literacy Lessons Teaching Life Skills Life Skills Lessons

Oecd Oecd Digital Asset Management Work Family Payroll Taxes

How To Sell Online Payslips To Your Employees Payroll Payroll Template Things To Sell

Hr Outsourcing

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Excel Templates Business

Joseph Fabiilli Usa Tax Laws Payroll Taxes Payroll Tax

Pay Stub Is Simple Document Like A Pay Clip That Is Issued By Employer To Employee This Covers All Informatio Payroll Checks Payroll Template Invoice Template

Important Things In Your Payslips Need To Check Payroll Template National Insurance Number Payroll Software

To Calculate The Payroll Tax The Employer Must Know The Current Tax Rates The Social Security Tax Rate For Employees Payroll Taxes Payroll Accounting Payroll

2020 Income Tax Withholding Tables Changes Examples Income Tax Income Filing Taxes

A Closer Look At Those Who Pay No Income Or Payroll Taxes Tax Policy Center Payroll Taxes Payroll Income

Generalcontractorbusiness Bookkeeping Business Business Tax Small Business Accounting

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

Pin On Pay Stub

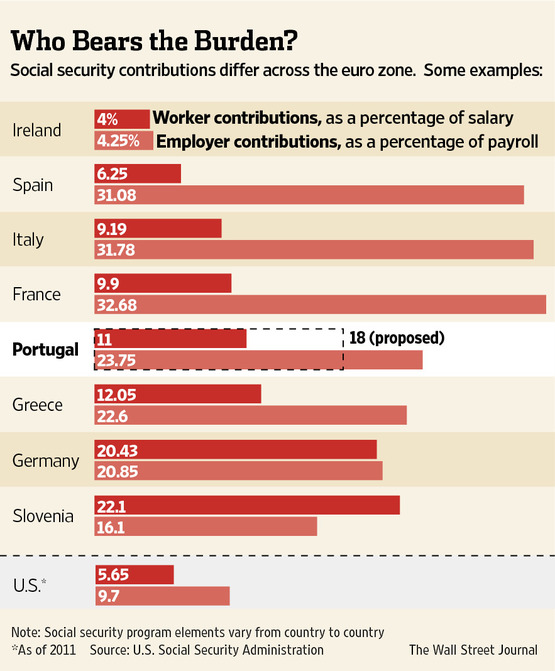

Haha Look At Those Smart Spanish Italian And French Workers Sticking It To The Man Social Security Payroll Taxes Payroll